Electric scooters have gone from curiosity to mainstream micromobility option in just a few years. As cities look to reduce congestion, improve air quality, and offer alternatives to short car trips, e-scooters have been a central test case for policymakers, operators and the public. Between 2025 and 2030 we’ll see a mix of accelerated adoption, clearer regulation, technical improvements, and new business models — but also continuing challenges around safety, enforcement and battery risks. Below I explain the most likely developments, why they’ll happen, and how riders, operators and local authorities will be affected.

Quick reality check: where things stand in 2025

Before predicting the future we must note the present baseline. Privately owned e-scooters remain illegal for general public use on UK roads, pavements and cycle lanes; only approved rental schemes operating in trial areas are permitted. This legal distinction is fundamental to what will — and will not — change over the next five years.

In 2025 the UK has been actively extending and expanding rental trials rather than immediately legalising private scooters. The trials have been opened up to allow more local authorities to participate and, in some cases, have been extended until at least 2028 while more evidence is gathered. That approach shapes short-term policy and industry strategy.

1) Regulation will move from “trial” to formal framework (but not overnight)

Prediction: By 2028–2030 the UK will publish a clear legal framework that allows regulated private e-scooters on selected public roads — but only after a transitional period of stricter technical and safety standards.

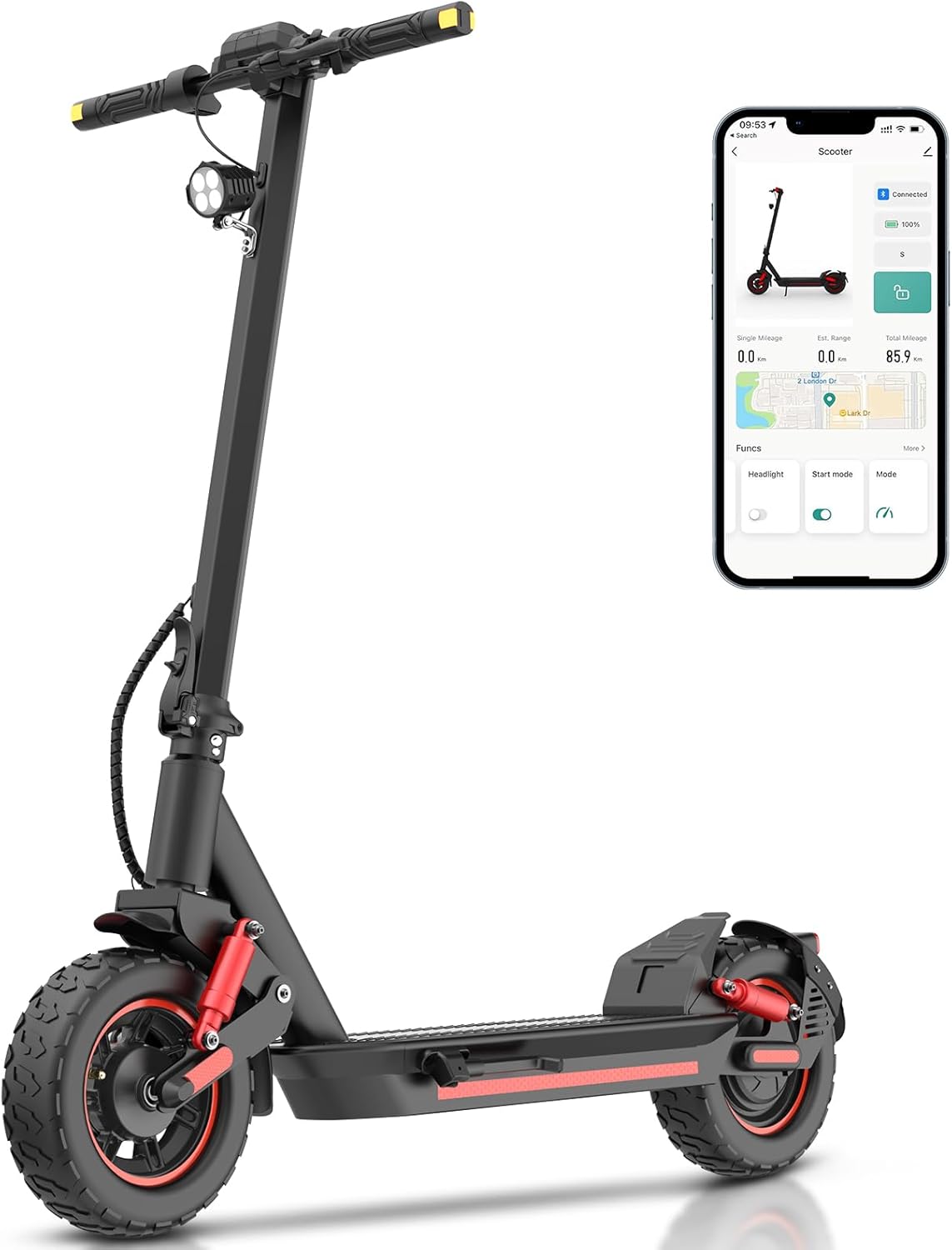

Why: The government has been gathering data from trials and is expanding those trials to test features such as variable speed zones, helmet programs, and parking enforcement. That indicates policymakers want granular evidence before writing final law. In practice, the step from trial to regulation typically takes multiple rounds of consultation, pilot adjustments and new standards for lighting, braking, speeds, registration and insurance. Expect gradual legalisation that is conditional: private e-scooters that meet defined technical specs (plates, insurance, braking standards) will be allowed, while cheaper, non-compliant imports may still be restricted.

What this means for riders and operators:

- Operators will continue to invest in rental fleets and infrastructure (parking bays, geofencing).

- Manufacturers will design models that meet anticipated standards (improved brakes, better BMS, tamper-resistant chargers).

- Early adopters who own non-standard scooters will still mostly use private land or risk enforcement until formal rules change.

2) Market growth: bigger fleets, more cities, larger revenues

Prediction: The UK e-scooter market will grow strongly through 2030 — both for rentals and (eventually) for compliant private ownership — with double-digit CAGR in revenue for the remainder of the decade.

Why: Multiple market reports and analyst forecasts point to robust growth in micromobility markets, driven by falling battery costs, consumer demand for short-trip solutions, and urban policies that favour low-emission transport. Operators who survive the current trial phase are likely to expand into new cities as they obtain local approvals; some consolidation of operators is also likely as large firms scale to cover multiple regions.

What this means for your site:

- More product review and local-comparison pages will attract traffic (city maps, rental operator reviews, helmet and lock roundups).

- Affiliate opportunities increase as riders look for helmets, locks and commuter accessories.

3) Safety and battery risk will shape policy and consumer trust

Prediction: Safety concerns — particularly lithium battery incidents and rider injuries — will drive tougher product standards and consumer education campaigns between 2025 and 2030.

Why: Fire and safety incidents tied to lithium batteries were a growing concern in 2024–2025, prompting regulators and safety groups to call for stronger product controls, approved chargers, and public awareness. Policymakers will likely require improved battery management systems (BMS), mandatory safe-storage guidance, and stricter import controls to reduce cheaply made batteries entering the market.

Practical outcomes:

- New scooters will ship with certified BMS, safer chargers, and clearer storage/charging instructions.

- Rental operators will tighten battery maintenance regimes and swap cycles.

- Insurers (when private scooter insurance is permitted) will price policies according to battery and product safety grades.

4) Infrastructure and micromobility integration will improve

Prediction: Cities will invest more in dedicated micromobility lanes, parking bays and curb management tools, especially around transport hubs and universities.

Why: To manage clutter, reduce conflicts with pedestrians, and encourage safe riding, local authorities will use trial learnings to fund and plan targeted infrastructure. Geofencing, mandatory parking bays and dedicated lanes around transit hubs will become more common. This is both a policy choice and an operational necessity for large fleets to avoid fines and community pushback.

Rider experience:

- Safer, more pleasant rides in places where micromobility lanes are implemented.

- Fewer illegal parking complaints and reduced clutter if operators comply with mandatory bays.

5) Business models will diversify: subscriptions, B2B and logistics

Prediction: Beyond pay-as-you-go, we’ll see subscription models, corporate commuter schemes, and more trials of light-goods delivery via small e-scooters or similar micro-vehicles.

Why: Operators need higher lifetime value per customer and steadier revenue. Subscriptions reduce lock-in friction; corporate schemes (for companies near stations or campuses) offer predictable revenue. Additionally, last-mile deliveries in congested city centres will prompt pilots for small electric cargo scooters and shared fleets dedicated to couriers. Market actors will test hybrid models that combine rentals for people and fleets for micro-logistics.

6) Technology improvements — safer, smarter, greener

Prediction: Batteries, telematics and software will improve: longer life cells, better thermal management, predictive maintenance, and smarter fleet routing that reduces deadhead miles.

Why: Economic pressure and safety drivers force both hardware and software innovation. Expect manufacturers to offer batteries with longer cycle life and built-in thermal sensors; operators will increasingly use predictive analytics to swap batteries before failures and optimize charging networks to reduce environmental and operational costs.

7) A clearer path to private ownership — but with strings attached

Prediction: By 2029–2030 the government will likely enable a regulated route for private scooters to use public roads — conditional on registration, insurance, and standards.

Why: Trials generate data but also show demand for private ownership. To reconcile safety and consumer demand, authorities will likely require private scooters to meet the same technical standards as rental models: speed governors, lighting, tamper-resistant batteries, and traceable ID/registration. Insurance products tailored to e-scooters will emerge, albeit at a price that reflects risk.

How to prepare as a rider or operator (practical checklist)

- Prioritise safety gear: helmet, reflective clothing and quality lights.

- If you run content or commerce: focus on high-value product reviews (helmets, chargers, locks) and city guides.

- For operators: invest in certified batteries and predictive maintenance tech; work with councils on parking bays.

- For consumers: avoid cheap off-brand batteries and chargers; follow safe storage and charging practices.

Final thoughts — realistic optimism

From 2025 to 2030 the UK will not see an overnight e-scooter revolution; instead it will be a steady, evidence-led expansion. Rental fleets will scale into more cities, the market will grow strongly, product safety and infrastructure will improve, and a regulated pathway for compliant private scooters will eventually emerge. The pace will depend on safety outcomes, local political buy-in, and how quickly manufacturers and operators can meet tougher standards. For website owners, riders and businesses, the coming five years are a chance to shape the conversation, prioritise safety and capture growing demand in a market that’s moving from experiment to everyday transport.